From: zerohedge

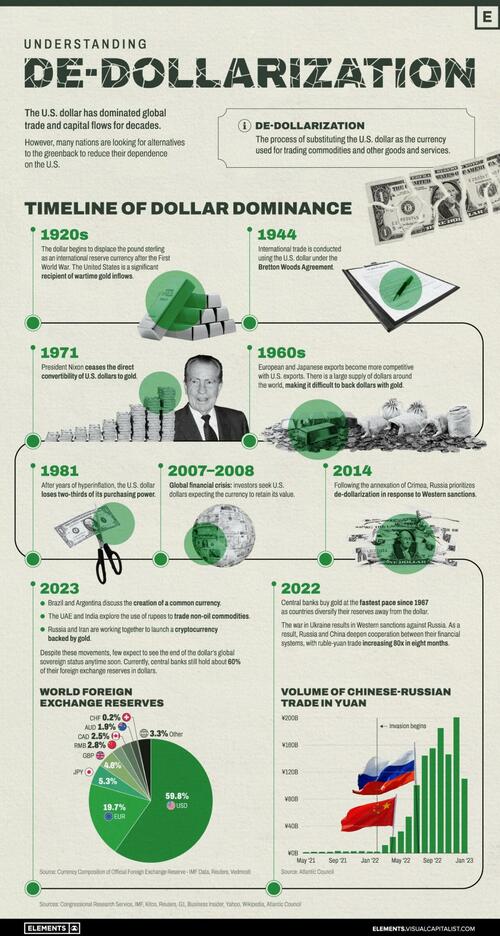

The U.S. dollar has dominated global trade and capital flows over many decades.

However, as Visual Capitalist’s Bruo Venditti details below, many nations are looking for alternatives to the greenback to reduce their dependence on the United States.

This graphic catalogs the rise of the U.S. dollar as the dominant international reserve currency, and the recent efforts by various nations to de-dollarize and reduce their dependence on the U.S. financial system.

The Dollar Dominance

The United States became, almost overnight, the leading financial power after World War I. The country entered the war only in 1917 and emerged far stronger than its European counterparts.

As a result, the dollar began to displace the pound sterling as the international reserve currency and the U.S. also became a significant recipient of wartime gold inflows.

The dollar then gained a greater role in 1944, when 44 countries signed the Bretton Woods Agreement, creating a collective international currency exchange regime pegged to the U.S. dollar which was, in turn, pegged to the price of gold.

By the late 1960s, European and Japanese exports became more competitive with U.S. exports. There was a large supply of dollars around the world, making it difficult to back dollars with gold. President Nixon ceased the direct convertibility of U.S. dollars to gold in 1971. This ended both the gold standard and the limit on the amount of currency that could be printed.

Although it has remained the international reserve currency, the U.S. dollar has increasingly lost its purchasing power since then.

Russia and China’s Steps Towards De-Dollarization

Concerned about America’s dominance over the global financial system and the country’s ability to ‘weaponize’ it, other nations have been testing alternatives to reduce the dollar’s hegemony.

As the United States and other Western nations imposed economic sanctions against Russia in response to its invasion of Ukraine, Moscow and the Chinese government have been teaming up to reduce reliance on the dollar and to establish cooperation between their financial systems.

Since the invasion in 2022, the ruble-yuan trade has increased eighty-fold. Russia and Iran are also working together to launch a cryptocurrency backed by gold, according to Russian news agency Vedmosti.

In addition, central banks (especially Russia’s and China’s) have bought gold at the fastest pace since 1967 as countries move to diversify their reserves away from the dollar.

How Other Countries are Reducing Dollar Dependence

De-dollarization it’s a theme in other parts of the world:

In recent months, Brazil and Argentina have discussed the creation of a common currency for the two largest economies in South America.

In a conference in Singapore in January, multiple former Southeast Asian officials spoke about de-dollarization efforts underway.

The UAE and India are in talks to use rupees to trade non-oil commodities in a shift away from the dollar, according to Reuters.

For the first time in 48 years, Saudi Arabia said that the oil-rich nation is open to trading in currencies besides the U.S. dollar.

Despite these movements, few expect to see the end of the dollar’s global sovereign status anytime soon. Currently, central banks still hold about 60% of their foreign exchange reserves in dollars.