From: zerohedge

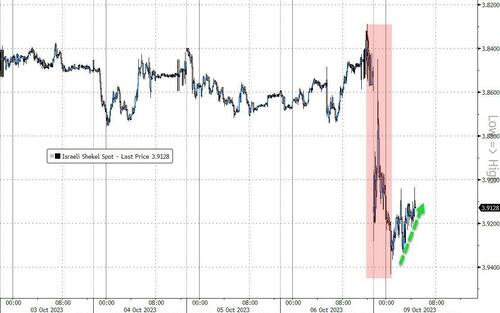

The Israeli Shekel tumbled overnight, down over 2% against the dollar, as the headlines – and images – of atrocities spread around the world.

However, the currency has now stabilized following remarks from The Bank of Israel (BoI) that it stands ready to provide up to US$30bn of FX liquidity in the spot market and up to US$15bn in swaps against the backdrop of depreciation pressures on the Shekel.

For now, BoI has said an emergency rate-hike is not on the table.

Israel’s benchmark TA-35 index tumbled over 6% on Sunday but recovered from early losses on Monday…

Economic activity will be likely disrupted, presenting a negative supply shock, according to Citigroup strategists including Michel Nies.

“At the same time, fiscal support would probably have to be stepped up, both for reconstruction and loss of income support as well as for strengthening security measures,” they say in note.

“A wide-scale call up of reservists could further reduce labor supply in an already tight labor market”

“This could though be partly offset by job destruction in areas affected by fighting. On the demand side, a lot will depend on general threat perception which might weigh on consumption in sectors like hospitality”

However, as Goldman notes, Israel’s underlying balance of payments position is much healthier today than it was during past major episodes of escalating tensions and conflict (>20 years ago), with a large current account surplus, a reduced reliance on foreign capital inflows, and an unusually large stock of foreign currency reserves (US$203bn, 39% of GDP).

This strong balance of payments position has reduced Israel’s economic and financial vulnerability to shocks and will ease the task of the Bank of Israel in addressing any financial stability implications from the conflict.

If the negative market reaction persists or intensifies, we would not rule out further response by the central bank either via policy rates and/or additional FX interventions.

In addition, in past episodes of conflict in the region, the Israeli economy has also benefited from significant financial inflows from abroad (from aid and other transfers).