From: zerohedge

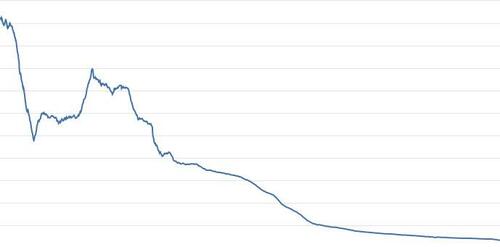

Before we get started this week, I want to show you a chart:

Now, if this chart showed the stock price of a company, would you want to invest in it?

If it’s the price of a commodity, would you be a buyer?

What if you were already heavily invested in this enterprise? Would you hold on and hope for better days ahead? Or would you look at that long downward slide and cut your losses, just walk away?

Now, when I say “long downward slide,” I do mean . Here’s a bit more information…

The chart above includes data for over a century — from January 1913 to October 2022.

True, over the last 70 years all hope for better days ahead has probably long since faded…

Well, this isn’t a stock chart. It’s not a commodity price.

This chart shows the weakening purchasing power of the U.S. dollar.

This may come as a surprise, considering how often we’ve been hearing about the “strength” of the U.S. dollar on mainstream media reports. The mighty dollar has been blamed for all sorts of troubles recently. For example:

Think about those charts I showed you. Today’s question is, how can the U.S. dollar be so strong as to cause all this ruckus?

The answer: it’s a matter of perspective…

The dollar’s strong (but only in comparison)

A strong currency is one that can buy more goods and services than other currencies. That’s not the case with the U.S. dollar.

In fact, the U.S. dollar is only “strong” in comparison to .

Take the euro for example. Adjusted for inflation, the euro has lost about 35% of its purchasing power since its introduction in 1999.

The yen? It’s down 23% against the dollar

Take a look at the three other major global currencies compared to the U.S. dollar and it’s plain as day, they’re not doing well…

As we’ve seen, the U.S. dollar has lost of its purchasing power since the Federal Reserve was established in 1913.

So the U.S. dollar is strong in comparison to other currencies… but than the U.S. dollar’s.

What’s really happening

The central banks of the world are engaged in a race to the bottom. They’re all printing money at an unprecedented rate, and the effects are being felt . It’s no coincidence that the worldwide inflation rate is “near double digits,” as Bloomberg recently reported (8.8% globally, according to the IMF — ranging from 2% — 210%).

Money-printing destroys the purchasing power of all the currencies involved, including the U.S. dollar.

to restore the purchasing power of the U.S. dollar is to stop the money printing. to do that is to end the Federal Reserve and return to a monetary system based on sound money.

When you hear talk of a “strong U.S. dollar,”. The U.S. dollar is only strong in comparison to other rapidly-depreciating currencies. The only way to restore global financial sanity is to return to a system of sound money such as the gold standard.

We must do this before the central banks of the world print into total collapse. Look at those charts again. We’re much, much closer to total collapse than we are to stability. And if all your savings are tied up in U.S. dollars, I strongly recommend examining the benefits of diversification.

Because the slowest loser is still a loser.