From: zerohedge

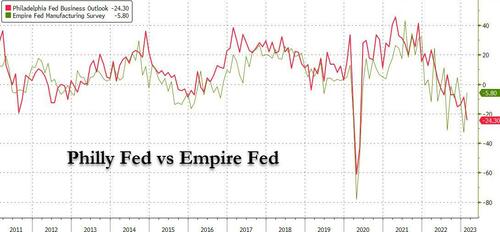

One day after the Empire State Manufacturing Survey surprised by surging from a post-covid low of -32.90 to -5.80, one of the biggest monthly increases on record, today it was the Philly Fed’s survey to surprise to the downside. Whether it was the bitter Superbowl hangover, or just New York’s economic malaise shifted to the southwest, in February the Philly Fed reported that its business outlook plunged from -8.90 to a recessionary -24.30, far below the -7.5 median consensus estimate, a sixth consecutive negative reading and the lowest reading since May 2020, the immediate depths of the covid crisis. Outside of covid, the last time the Philly Fed printed this low was in April 2009, in the immediate aftermath of the global financial crisis.

Commenting on the survey responses, the Philly Fed noted that general activity index declined further, the new orders index remained negative, and the shipments index remained positive but low. The employment index declined but remained positive, and the price indexes continued to suggest overall increases but were in line with long-run averages. Most of the survey’s future indicators were positive but low, suggesting tempered expectations for growth over the next six months.

While the Future activity index remains modestly in expansion territory, the current indicators remained extremely weak and in deep contraction.

The diffusion index for current activity fell from a reading of -8.9 last month to -24.3 this month (see Chart), its sixth consecutive negative reading and lowest reading since May 2020. Thirty-one percent of the firms reported decreases (down from 33 percent last month), exceeding the 7 percent reporting increases (down from 24 percent); 57 percent of the firms reported no change in current activity (up from 37 percent last month). The index for current new orders declined 3 points to -13.6, its ninth consecutive negative reading, and the current shipments index edged down 2 points to 8.7.

The current employment index remained positive but decreased from 10.9 to 5.1 this month. Most firms (61 percent) reported steady employment levels, 21 percent of the firms reported higher employment, and 15 percent reported lower employment. The average workweek index fell from 4.0 to -3.2.

Meanwhile, the diffusion index for future general activity declined 3 points but remained positive at 1.7. Almost 29 percent of the firms expect an increase in activity over the next six months, narrowly exceeding the 27 percent that expect a decrease. The future new orders index rose from 2.4 to 9.2, while the future shipments index declined from 9.1 to 4.6. The firms expect increases in employment overall, as the future employment index rose 10 points to 8.1, after dipping into negative territory last month. Both future price indexes were below their long-run averages. The future capital expenditures index edged down 3 points to 7.5.

In this month’s special questions, the firms were asked to forecast the changes in prices of their own products and for U.S. consumers over the next four quarters (see Special Questions). Regarding their own prices over the next year, the firms’ median forecast was for an expected increase of 4.5 percent, down slightly from 4.8 percent when this question was last asked in November. The firms reported a median increase of 7.0 percent in their own prices over the past year, down from 7.5 percent in November. The firms’ median forecast for the rate of inflation for U.S. consumers over the next year was 4.0 percent, down from 5.0 percent in November. Over the long run, the firms’ median forecast for the 10-year average inflation rate was 3.0 percent, down from 4.0 percent in November.

In summary, responses to the February Philly Fed Mfg Survey suggest “continued overall declines in the region’s manufacturing sector this month.” The indicators for current activity and new orders remained in negative territory, while the shipments index remained positive but low. The firms continued to indicate overall increases in prices paid and received.

That said, considering how erratic all the various regional Feds have been in recent months, it’s becoming next to impossible hard to put any faith in any of these surveys.