From: zerohedge

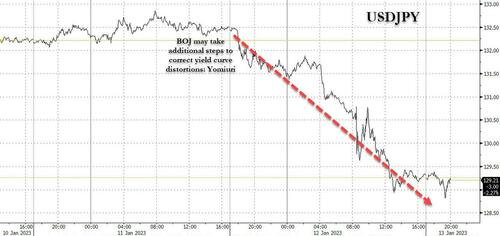

Overnight the Japanese yen soared (if not quite as much as it did last month when the BOJ unexpectedly doubled the trading band of its Yield Curve Control to +/- 0.50% sparking the biggest surge in the Japanese currency since LTCM and the 1998 Asian Crisis), after Japan’s Yomiuri reported that the BoJ is to review the side effects of its massive monetary easing at its policy meeting next week and may take additional steps to correct distortions in the yield curve due to skewed interest rates despite last month’s tweak in its bond yield control policy. Translation: there is a chance the BOJ will once again “surprise” the market with yet another YCC tweak. The news predictably unleashed a surge in the yen as it would mean outgoing BOJ head Kuroda will need to buy even less bonds, inject less liquidity, and implicitly prop up the currency; as of 8:00pm ET, the USDJPY had tumbled as low as 128.66 from 132 yesterday, before bouncing modestly just above 129.

Of course, the offset within Japan’s impossible dilemma – which as regular readers know states the BOJ can have a strong yen or bond market stability but not both at the same time – is that a stronger yen means not only weaker exports and less inflation (which may be good for Japan now but will be anything but once deflation returns in a few months), but also bond market chaos.

And sure enough, moments after the JGB market reopened on Friday, the 10Y yield soared above 0.50%, rising as high as 0.568%…

… before recovering some losses after the BOJ announced yet another unlimited fixed-rate bond buying operation intended to stabilize the selloff.

There is just one problem: these operations are starting to pile up quite ominously: on Thursday, the Bank of Japan spent a record ¥4.6 trillion ($35 billion) on its various bond-buying operation as yields stayed at the upper end of the trading range that it permits. The amount surpassed a previous record high of ¥2.21 trillion set on June 14. And with the BOJ about to go into overdrive it will surely blow another record amount tonight to prevent an all out collapse of its bond market.

This is a problem, because as IIF strategist and former Goldman FX analyst Robin Brooks showed last week, the BOJ had already had to buy 16.2 trillion Yen in JGBs to defend the new cap, and pointed out correctly that

Oh. My. God. BoJ lifted the ceiling for 10-year JGB yield from 0.25 to 0.50% last month and here’s the result: it had to buy 16.2 trillion Yen in JGBs to defend the new cap. Exiting any peg – in this case a yield cap – is extremely costly. A warning for any yield cap proponents. pic.twitter.com/3HwjfBIKp3

— Robin Brooks (@RobinBrooksIIF) January 4, 2023

Well, we can now make that over 20 trillion – – in just the past three weeks to defend the YCC peg which as of this moment no longer exists and is, at best, a moving target which may (or may not) move to 75bps or more next week – nobody really knows, which is why everyone is selling first and asking questions later; and until the market finds out what the new bogey is, it will keep dumping JGBs and forcing the BOJ to intervene with unlimited – and unscheduled – bond buying operations, as it did again today.

Unfortunately for the BOJ, the longer this confusion continues, the faster the BOJ will be forced to not only drain its existing cash balance but actively liquidate its UST holdings, of which it had roughly $1.08 trillion (down from $1.32 trillion a year ago). Not surprisingly, 10Y TSY yields moved higher around the time the BOJ lost control of the yield curve: the market is starting to again frontrun the BOJ selling of US paper.

What happens next? Well, if the BOJ is unable to restore confidence to the bond market – and its ongoing strategy has demonstrated it has no idea what it is doing – and it is indeed forced to dump TSYs, sending yields sharply higher, the Fed will have no choice but to once again step in and offset BOJ bond buying. That’s right: the Fed may have to restart QE not so much to prop up US stocks but to avoid a bond market rout just as Zoltan Pozsar already predicts that the Fed will have to restart QE anyway (see “A “Checkmate-Like” Situation: Zoltan Pozsar Says Fed Will Restart QE By The Summer Of 2023“), and for a far simpler reason: a massive supply/demand imbalance in the US TSY issuance market this year, once which leads to market chaos and brings the Fed out of hibernation.

At that point, a printing orgy will commence between the Fed and BOJ, one which will inevitably drag in every other central bank, as the new normal race of outprinting everyone else reasserts itself now that inflation is apparently no longer a big concern to the Fed.